By Rachael Lockyer, Head of Australia – MLC Private Equity

Nobel prize winner Harry Markowitz famously stated that “the only free lunch in finance is diversification”, because when done properly, diversification has the potential to reduce your overall risk while sacrificing little – if any – long term return. From a private equity perspective, diversification means allocating capital across different geographies, PE managers and sectors, such that the impact of potential macro-economic and idiosyncratic risks are minimised. However, retail investors must be careful diversification doesn’t result in a “PE beta” outcome, and the ability to generate outsized returns is retained through investing in a diversified yet curated selection of high-quality PE managers and investments.

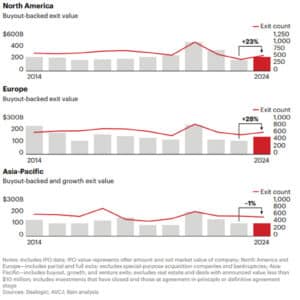

Over the past 5 years we have experienced a global pandemic, higher valuations, rising inflation, labour scarcity, rising then falling interest rates, geopolitical tensions including wars in the Middle-East and Russia/Ukraine, a trade war, and increased macro-economic uncertainty. Looking back over 2024, some regions were able to successfully navigate exits, such as in Europe and North America, where PE exits increased 28% and 23% on prior years respectively, however Asia-Pacific really struggled with exit value down 1% on 2023 levels 1. Exiting businesses in China remains very difficult.

Private equity exit activity varies by region

This is when geographic diversification really matters. When a PE company is exited, it typically generates increased value compared to the valuation held on the investment 6 months prior to exit; and as such more exits mean better returns for investors (not to mention, cash being returned). The exit market is fragile, and geographic specific depending on the macro-economic and business outlook, and whether corporates or financial sponsors are feeling confident enough to buy businesses.

Hand in hand with active management strategies comes manager diversification. Key people are the life blood of private equity value creation. The difference between a top quartile manager and a bottom quartile manager is its people and their personal skills in buying the best businesses, working with founders and management to improve and grow them, and selling these businesses to buyers who value their future growth opportunities. There is a growing gap between the performance of top and bottom quartile managers.

Widening gap between top and bottom quartile managers

Unfortunately, people and their unique life events are inherently unpredictable. Life events happen and PE managers are not immune – a terminally ill family member, divorce, personality clashes between partners, and even death can unfortunately occur to PE managers during the life of a PE investment. Manager diversification, and multiple “key people” within the manager, is critically important to maintain strong returns from investments in the unfortunate event a key person becomes distracted.

The risk of PE beta

There are large private equity platforms that have raised significant capital and therefore participate in hundreds if not thousands of deals, across hundreds of PE managers. As funds become larger, investment selectivity becomes more difficult with a pressure to deploy capital. Despite the diversification this strategy may pursue, it offers a broad exposure to the PE asset class and reduces the chance of outperformance. This is what many refer to as “PE beta” — returns that broadly reflect the market. Increased scale of funds often coincides with returns reverting to the mean, and then fees and carry further detract from returns.

For investors seeking true long-term value creation, PE beta isn’t enough. The goal should be to capture alpha through selective partnerships with a diversified set of high-conviction managers. This involves deeper diligence, long term relationship-building, and a willingness to back sector specialists.

The alpha in specialisation

Sector specialist mid-market managers are often better positioned to generate alpha – that is, generate returns above what the general PE market offers. These managers possess deep domain knowledge, longstanding industry networks, and operational insights allowing them to identify opportunities others miss, and lean in when they see “best of breed”.

As the broader PE market matures and becomes more efficient, our view is specialist managers outperform generalists. The ability to source proprietary opportunities and add value post-investment with a repeatable playbook becomes a critical differentiator. Specialist PE managers have outperformed generalist managers by 0.5% per year over the past 15 years, according to global private equity data from Preqin 2. Compounded over 15 years, the absolute outperformance becomes significant. Specialists possess a deep understanding of the specific dynamics surrounding companies in their sector (including regulation and competition), extensive industry knowledge and networks, and ascend the J-curve more rapidly due to their expedited implementation of value creation strategies.

Diversification, done right

Global private equity investing isn’t just about allocating capital—it’s about making strategic decisions that maximise long-term returns. Maintaining a carefully curated geographically diversified selection of high quality managers, including (i) sector specialists, (ii) value focused generalists and (iii) growth focused generalists, has enabled our PE program’s long term alpha generation. By focusing on smart diversification investors can enjoy the “free lunch” whilst generating alpha, and not simply PE beta.

- Bain Capital Global Private Equity Report, 2025. https://www.bain.com/insights/topics/global-private-equity-report/

- Preqin, October 2024. Reflects median IRR outperformance of global private equity specialist managers compared to generalist managers from 2008-2023.

Important information

The financial products or strategies described in this article are available for investment by Australian residents only (and some New Zealand residents), and any financial product advice is intended for Australian residents only and not for residents of any other jurisdiction.

This communication has been prepared for licensed financial advisers and Wholesale Clients as defined in section 761G of the Corporations Act 2001(Cth) only and must not be distributed to retail investors under any circumstances. This communication was prepared by MLC Asset Management Pty Limited, ABN AFSL (“MLC” or “we”), a part of the Insignia Financial group of companies comprising Insignia Financial Ltd ABN 49 100 103 722 and its related bodies corporate (Insignia Financial Group). The capital value, payment of income and performance of any financial product referred to in this communication or marketed in connection with this communication are not guaranteed.